BENEFITS OF OUR AI

Direct impact on ROI, data health and NPS.

process claims

in minutes

instead of days

in minutes

instead of days

+ speed

handle growth

aND

peak volumes

aND

peak volumes

+ scalability

reduce overpayments

and

financial leakage

and

financial leakage

- fraud

avoid

human errors

in data entry

human errors

in data entry

- errors

ADAPTS TO YOUR BUSINESS

Built for control, not constraints

PRIVATE

In your own public cloud infrastructure or in M47’s but always ensuring maximum security, privacy, and regulatory compliance.

INTEGRATED

Fully integrates with your existing systems, including CRMs, ERPs, and other business platforms, ensuring seamless workflows and unified data management across all operations.

MONITORED

Continuously monitored in production to track performance, detect AI drift, identify errors, and ensure accuracy and reliability over time.

CUSTOMIZABLE

Tailored to fit your needs, because every company is unique. Underwriters, Assistance companies, TPA´s, MGA´s. Our AI adapts seamlessly to your processes.

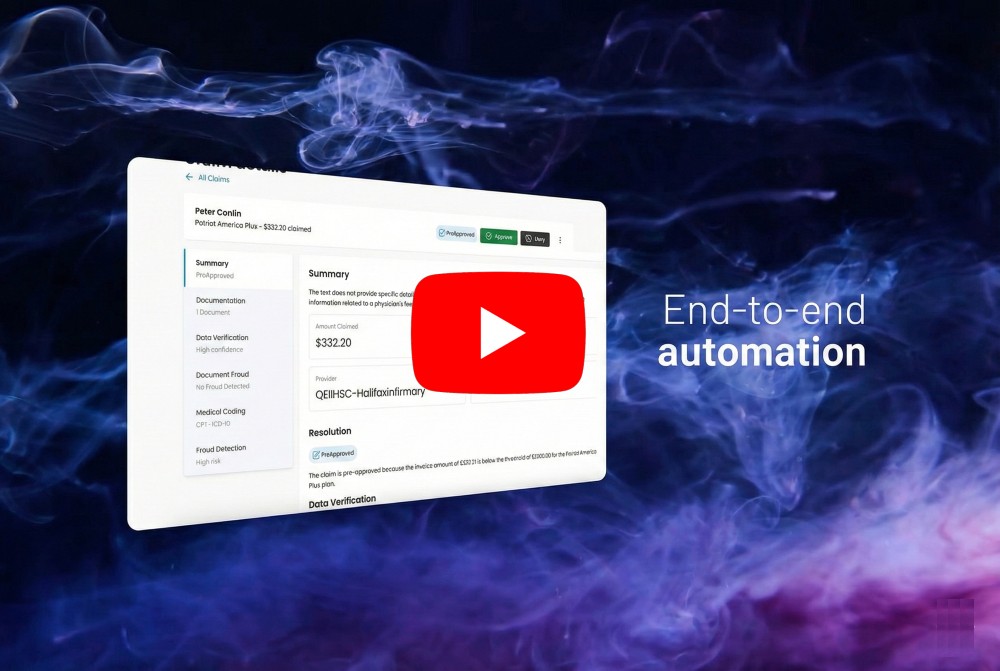

HOW IT WORKS

Less than 1 minute

Automating the claims journey from intake to resolution

Intake

Automates the capture, verification, and understanding of claim information from documents and unstructured data.

Validation

Normalizes, validates, and standardizes claim data by applying business rules, coding, and internal checks.

Fraud Detection

Identifies inconsistencies, document manipulation, and risk patterns across the claim lifecycle.

Resolution

Enables straight-through processing for standard claims and prepares resolution recommendations for human review.

Action

Executes post-resolution actions, including system synchronization, communications, and task guidance for agents.

Testimonials

What they say about us

"claims47 helped us transform a slow, manual process into something faster and more consistent. The AI system they helped us build assists our teams in reviewing medical forms, reducing human workload by up to 80%, while ensuring that final decisions remain in expert hands and fully comply with regulatory standards."

FEATURES

A bunch of AI capabilities that sits on top of your existing systems.

INTAKE

Smart Data Capture

Leverages advanced AI-powered OCR to extract key information from physical documents like PDFs and screenshots, accurately capturing complex layouts and tables.

Document Verification

Ensures that the right documents are uploaded for each claim. Using AI-powered analysis, it automatically classifies documents like invoices, medical reports, bank statements or national IDs, verifying that they match the required types for the claim.

Insightful Claim Summary

Uses AI to quickly and accurately summarize claims reports, extracting key details and providing concise overviews.

VALIDATION

Precision Data Matching

Ensures accuracy by validating extracted data against internal databases, such as matching provider names with hospitals.

Medical Coding

Automatically maps medical terms to standardized codes (e.g., ICD-10-CM, CPT), ensuring precise data representation with minimal manual intervention.

Data Structuration

Normalizes and structures unstructured information across documents, turning it into consistent, reliable data ready for validation, analysis, and integration with claims systems.

FRAUD

Document Fraud Detection

Leverages AI to identify fraudulent modifications in documents, such as altered invoice amounts or falsified details. AI-driven pixel-level analysis detects tampered areas in scanned documents, while autoencoder models flag anomalies by learning the typical structure of legitimate documents.

Fraud Detection

Leverages AI to analyze claim patterns and compare them against vast historical data to identify anomalies and inconsistencies.

RESOLUTION

Assisted Resolution

Applies coverage rules and verification logic to evaluate each claim, preparing clear, auditable resolution outcomes that support consistent and informed human review.

Straight-Through Processing

Automatically resolves standard, low-risk claims that meet predefined criteria, enabling straight-through processing for approved scenarios.

ACTION

Claims System Synchronization

Sends validated and structured data back to claims management systems such as Salesforce, ensuring systems remain up to date and aligned without manual re-entry.

Instant Communication

Automatically keeps claimants informed at every stage of the claims process through timely, personalized communications based on claim status and business rules.

Agent Communication and Task Guidance

Guides internal teams by surfacing required actions, next steps, and priorities, helping agents focus on exceptions and resolve claims more efficiently.

PLUS

Dashboard

Provides real-time visibility across the entire claims lifecycle through a web-based dashboard, enabling teams to monitor status, progress, and exceptions at a glance.

Machine Translation

Automatically converts key claim fields into the destination language set in the system. AI-powered language translation ensures accuracy, preserving critical medical, legal and technical terminology.

Currency Converter

Automatically converts invoice values into a predefined currency using real-time exchange rates. AI detects and normalizes currencies from symbols, abbreviations, and contextual clues, ensuring accurate conversions even in ambiguous cases.

Why us?

Over 20 years of experience in the insurance and tech world.We understand claims and AI, and we partner with major companies internationally to help their transformation journey.